All Categories

Featured

Table of Contents

These commissions are built into the purchase price, so there are no surprise fees in the MYGA agreement. That indicates acquiring numerous annuities with staggered terms.

For instance, if you opened up MYGAs of 3-, 4-, 5- and 6-year terms, you would have an account maturing each year after three years. At the end of the term, your money can be taken out or taken into a new annuity-- with luck, at a higher price. You can also make use of MYGAs in ladders with fixed-indexed annuities, a strategy that seeks to take full advantage of yield while additionally protecting principal.

As you compare and comparison images offered by numerous insurance provider, take into consideration each of the areas listed above when making your final choice. Recognizing agreement terms along with each annuity's advantages and disadvantages will certainly enable you to make the very best choice for your economic scenario. longevity annuity vanguard. Believe thoroughly concerning the term

Annuities Provide For Withdrawal Options

If interest rates have risen, you might want to lock them in for a longer term. Throughout this time, you can obtain all of your money back.

The firm you acquire your multi-year ensured annuity via concurs to pay you a set rate of interest on your costs quantity for your picked amount of time. annuity rate definition. You'll get passion credited often, and at the end of the term, you either can renew your annuity at an updated price, leave the cash at a dealt with account rate, elect a negotiation choice, or withdraw your funds

Because a MYGA provides a set passion rate that's guaranteed for the contract's term, it can offer you with a foreseeable return. Defense from market volatility. With rates that are established by agreement for a particular number of years, MYGAs aren't based on market fluctuations like other investments. Tax-deferred growth.

Deferred Annuity Payout Calculator

Annuities normally have penalties for early withdrawal or abandonment, which can limit your capacity to access your money without fees - cashing out an annuity early. MYGAs may have reduced returns than stocks or mutual funds, which might have higher returns over the long term. Annuities usually have abandonment costs and administrative costs.

MVA is an adjustmenteither positive or negativeto the collected worth if you make a partial surrender over the complimentary quantity or fully surrender your agreement throughout the abandonment fee period. Due to the fact that MYGAs supply a set price of return, they might not maintain speed with rising cost of living over time.

Annuity Definitions And Terms

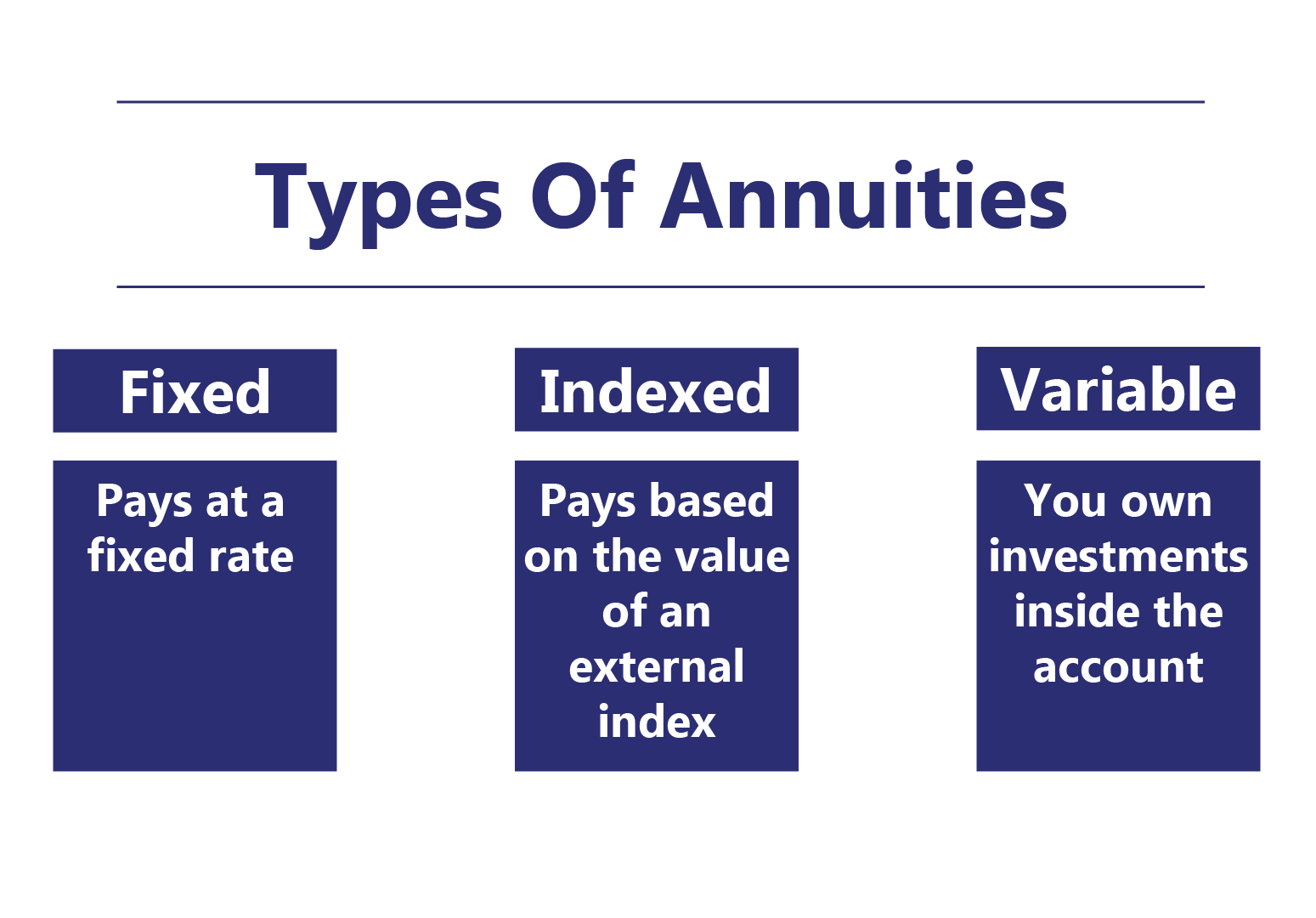

MYGA prices can alter usually based on the economy, yet they're commonly higher than what you would certainly make on a cost savings account. Need a refresher on the four basic types of annuities? Find out more just how annuities can guarantee a revenue in retired life that you can't outlive.

If your MYGA has market price adjustment stipulation and you make a withdrawal before the term mores than, the company can change the MYGA's abandonment value based upon changes in rates of interest. If rates have actually boosted because you bought the annuity, your abandonment worth may decrease to represent the greater rates of interest atmosphere.

Not all MYGAs have an MVA or an ROP. At the end of the MYGA period you've selected, you have three options: If having an ensured rate of interest price for an established number of years still aligns with your financial technique, you just can renew for another MYGA term, either the exact same or a different one (if readily available).

IUL insurance is an essential tool for the infinite banking strategy. Using Indexed Universal Life for infinite banking lets you take control of your finances.

By borrowing against your Indexed Universal Life policy’s cash value, you can fund major expenses while your money continues to grow tax-free (affordable annuities from agents). Insurance brokers specializing in Indexed Universal Life help you structure policies for infinite banking

With features like cash value growth and tax-free loans, IUL supports personal and business goals. Learn how Indexed Universal Life can transform your finances with a free consultation from a licensed broker.

Typical Annuity Payments

With some MYGAs, if you're not exactly sure what to do with the money at the term's end, you do not have to do anything. The built up value of your MYGA will move right into a repaired account with a sustainable 1 year interest rate figured out by the company. You can leave it there up until you select your following action.

While both offer ensured rates of return, MYGAs often use a higher rate of interest than CDs. MYGAs grow tax obligation deferred while CDs are exhausted as earnings each year. Annuities expand tax obligation deferred, so you do not owe income tax on the profits till you withdraw them. This permits your incomes to worsen over the term of your MYGA.

With MYGAs, abandonment fees might apply, depending on the type of MYGA you select. You might not just shed rate of interest, yet also principalthe money you initially added to the MYGA.

Top Annuity Insurance Companies

This indicates you may weary however not the principal amount added to the CD.Their conservative nature frequently allures extra to individuals that are coming close to or currently in retired life. They may not be ideal for every person. A might be appropriate for you if you wish to: Make the most of an assured rate and lock it in for a duration of time.

Take advantage of tax-deferred profits growth (5 million dollar annuity). Have the alternative to choose a settlement alternative for an assured stream of revenue that can last as long as you live. Just like any type of savings automobile, it is essential to carefully examine the conditions of the product and seek advice from to establish if it's a wise option for achieving your individual needs and objectives

Retail Annuities

1All guarantees consisting of the fatality benefit settlements are reliant upon the cases paying capacity of the providing business and do not apply to the investment performance of the hidden funds in the variable annuity. Assets in the hidden funds undergo market risks and may fluctuate in worth. Variable annuities and their hidden variable financial investment options are sold by syllabus just.

Please review it prior to you invest or send out cash. 3 Present tax legislation is subject to analysis and legislative change.

High Yielding Annuities Fixed

Entities or individuals dispersing this info are not licensed to give tax or legal guidance. People are encouraged to seek details guidance from their individual tax obligation or lawful guidance. 4 , Just How Much Do Annuities Pay? - immediate lifetime annuity calculator 2023This product is planned for public usage. By supplying this material, The Guardian Life Insurance Policy Business of America, The Guardian Insurance & Annuity Business, Inc .

Table of Contents

Latest Posts

Breaking Down Annuity Fixed Vs Variable Key Insights on Fixed Vs Variable Annuities Breaking Down the Basics of Fixed Annuity Or Variable Annuity Benefits of Choosing Between Fixed Annuity And Variabl

Decoding Retirement Income Fixed Vs Variable Annuity Everything You Need to Know About Annuity Fixed Vs Variable Defining the Right Financial Strategy Advantages and Disadvantages of Immediate Fixed A

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Features of Immediate Fixed Annuity Vs Variable Annuity Why Choosing the R

More

Latest Posts